What is a Debt to Income Ratio?

Of course, you're going to need money to repay an auto loan. But lenders aren't just concerned with the money you have coming in – they're concerned with the money that's going out as well. This is especially true if you're a bad credit borrower.

When you have a credit score of around 670 or lower, you're most likely to qualify for an auto loan through a subprime lender. These third-party lenders work through special finance dealerships and help people in unique credit situations to get the loans they need.

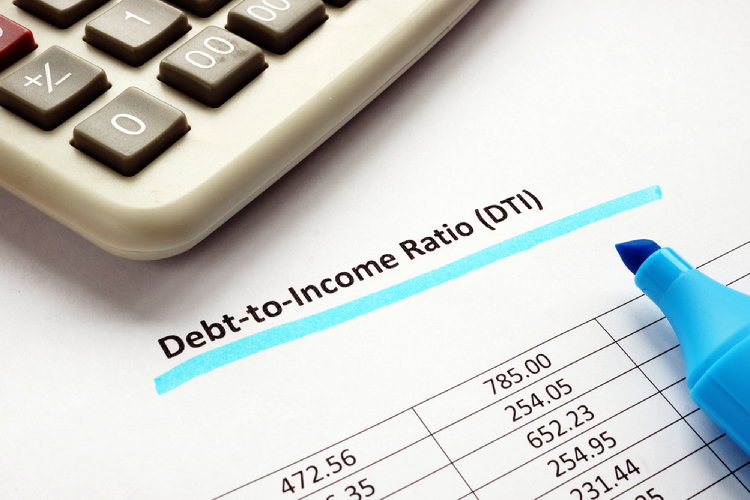

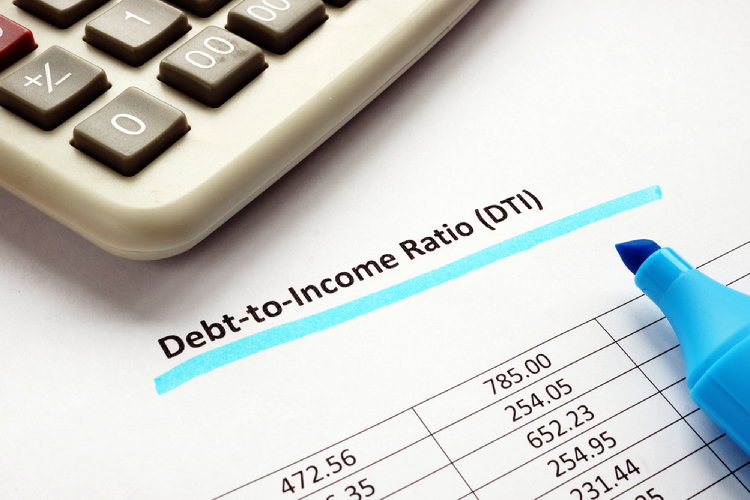

In order to do this, they use additional factors besides your credit score to ensure you're fit for financing. One of the factors that a subprime lender uses to determine your eligibility is your debt-to-income ratio. DTI tells a lender how much available income you have in your budget each month to pay for your car loan and the required full coverage auto insurance.

You find this number by dividing your monthly debts by your gross monthly income (before taxes).

Why is DTI Important for Car Loans?

Your DTI is important for car loans because this tells the lender if you can comfortably afford to make your required payment each month. If you're running with too much debt there is an increased risk of default, and lenders don't typically want to take that risk. If you don’t have enough income left after paying your bills, it can be difficult to qualify for a bad credit auto loan. This is especially true if you’re a bad credit borrower.

In order for a borrower to qualify for an auto loan, they usually need to have a DTI of lower than 50%. According to Investopedia, newer figures indicate that auto lenders typically cap a borrower's DTI around 43% of their income, but prefer a DTI of 36% or lower.

If you don't have at least this much of your budget free for your loan payment, auto insurance, and associated monthly costs, the lender may see you as a red flag.

It’s important that your vehicle payment fits comfortably into your budget. Even lenders want you to be able to afford your car, as it's best for both involved parties. When it comes to budgeting for an auto loan, your DTI ratio is important, but it’s only one piece of the puzzle.

How to Calculate Debt-to-Income Ratio for a Car Loan

To determine if you have enough available income to begin shopping for your next auto loan, you calculate your debt to income ratio by adding up your existing bills, and dividing the total by your gross monthly income. The resulting number is a decimal representing the percentage of debt you're already using. Personal and incidental items, such as groceries, don't need to be included when calculating your DTI ratio.

For example: When your rent ($500), potential vehicle payment ($375), car insurance ($100), and minimum credit card payments ($200) add up to $1,175 each month, and your gross monthly income is $3,200, your DTI ratio is approximately 37%. You find this by dividing $1,175 by $3,200 to get 0.367, or 36.7%.

In this case, you now know that your debt to income ratio falls below the typical maximum allowed DTI ratio for a bad credit auto loan. When it comes to your debt-to-income ratio, lenders place a cap of 45% to 50% on bad credit borrowers. This means that if more than half your income is already being used for bills, you likely won't get approved. In fact, the lower your DTI ratio, the better.

However, this is just the tip of the budgeting iceberg.

Other Budgeting Factors to Consider

In order to truly see how much you can afford for a car loan, you should also take into consideration how much of your income is needed for your vehicle payment.

Using the example above, we can see that a car payment of $375 a month is approximately 12% of your available income. We find this out by dividing the vehicle payment by your gross monthly income: 375 divided by 3200 equals 0.117, or 11.7%.

This is called your payment to income (PTI) ratio. Bad credit lenders typically don't allow a car payment to exceed 15% to 20% of your gross monthly income, but the lower the better.

Now that you are aware of the DTI ratio and PTI ratio guidelines, you should also consider things like loan terms, interest rates, and insurance costs. When planning your auto loan budget with bad credit, remember you're going to have a higher than average interest rate due to your credit issues.

Because of this, you need to carefully consider how long your loan should be. Sure, an 84-month loan might make your monthly payment more affordable, but do you really want to be making payments on a vehicle for seven years? Plus, the longer you stretch your loan term, the more you end up paying in interest charges.

As for insurance costs, you're required to carry full coverage insurance while you're financing a car. Full coverage differs from the minimum amount of coverage determined by the state you live in, and it could be much higher than what you're used to paying if you don't have a full coverage policy now.

How to Understand Your DTI Ratio?

When it comes to debt to income ratio, it's important to know what lenders consider a good DTI and what they don't This will help you understand your DTI, and how you balance your spending against your income.

Here's a breakdown to understand your DTI:

- 50% or more: You will typically have trouble qualifying to take on new debt if you're already using more than half your income to live. It is highly recommended that you take action against your debt.

- 43% to 50% DTI: You may be throwing lenders red flags in this category, and you are likely to have trouble borrowing money. Strongly consider paying down the debt you owe before seeking a new loan.

- 36% to 42% DTI: This level of debt can still be a concern to lenders, and you may have to take extra steps to qualify for lending.

- 35% or less: This signals to lenders that your debt is likely manageable compared to your income and you shouldn't have trouble qualifying for a new loan or line of credit.

What is the Max Debt-to-Income Ratio for a Car Loan?

As a general rule, auto lenders cap your DTI ratio to 45% to 50%. This means that with the projected car payment and auto insurance payment that you’re applying for factored in, at least half of your income should be still available.

Even if you make decent money each month, lenders want to know how much of that income is going to feasibly be available to afford the car payment. If you make $2,000 of income a month but your credit card payments, rent, and student loan payments are $1,500 a month, that means your DTI ratio is already at 75%. If you factor in a car loan payment and insurance premium, it’s likely to push your budget to the max – which an auto lender wants to avoid doing.

A high DTI ratio can be risky for you because if you do get approved for a car loan and you don’t have much wiggle room in your monthly budget, it could lead to missed payments on the car loan if unexpected expenses crop up.

When it comes to the DTI ratio, the lower it is, the better. Ideally, you want your DTI ratio to be under 45% with the projected car payment and insurance premium included. The more income you have available, the higher your odds are for meeting a lender's requirements.

How Lenders Check Your DTI Ratio

Lenders calculate your DTI by dividing your monthly recurring debts and payments by your gross monthly income. By doing this, they get a decimal answer. Once converted to a percent (by multiplying by 100), subprime lenders can see how much of your income is already being used by your recurring debts.

For example: If your gross monthly income is $2,500 and the total of your existing bills is $1,200 each month, 1200/2500=0.48, which means your DTI is 48%.

To calculate this yourself, you need to know how much you make before taxes each month, and the total of all your loan payments, mortgages (rent), insurance payments, and credit card bills each month (you don't need to include living expenses like food, or utilities in your math). Don't forget to include an estimated car loan payment and auto insurance in your calculations.

If you're not sure how much of a car loan you might qualify for, you can use online tools to help you do the math.

How to Reduce Your Debt-to-Income Ratio

Since DTI is such an important factor in a bad credit car loan decision, it's possible for a borrower to meet all the other requirements laid out by a lender and still get turned down for not having enough available income.

In order to qualify for a car loan, subprime lenders typically require you to provide proof that you make around $1,500 to $2,500 a month before taxes, from a single source. Once you meet that initial income qualification, you can let the lender know if you have any additional forms of income.

By increasing the amount of income you're bringing in, you can prove to a lender that you have enough wiggle room in your budget for auto financing. The additional income that can count towards your DTI can come from a second job, alimony, child support, rental income, or even Social Security or permanent disability – as long as you can prove that the income will continue throughout the entire loan term. This often means bringing in award letters, court documents, receipts, bank statements, or tax forms to the dealership.

If you don't have the extra income sources to pad your DTI ratio, you can always take a look at your monthly spending and try to cut down where you can.

Debt-to-Income Ratio FAQs

Here are some of the most frequently asked questions about DTI.

Why does DTI matter so much to a subprime lender?

Believe it or not, it matters because they want you to succeed with your auto loan. Lenders aren't in the business of making bad deals that a borrower can't repay. If that were the case, lenders would stand to lose more than they make.

To ensure that you have the ability to repay a car loan, subprime lenders typically require that not more than 45% to 50% of your income is being used by your debts. If you already have a lot of payment obligations, you're more likely to risk running into trouble with a car payment if something unexpected happens. Lenders are trying to help you avoid an auto loan default from the very start.

What about income requirements?

How much income you bring in each month is also just as important as your DTI ratio.

If you have poor credit and you’re working with a subprime lender, expect them to require around $1,500 to $2,500 of gross monthly income to be eligible for a car loan. Keep in mind that lenders look at your income pre-tax – so when applying for an auto loan, be sure to list your gross income and not your net.

Auto lenders typically require you to meet their income requirements with a single income source. However, your DTI ratio does usually include all your additional income sources. If you have other sources of income outside of your regular job, be sure to list them, because it could help you lower your DTI ratio.

Does DTI affect your credit score?

Your debt-to-income ratio doesn't affect your credit score, though credit bureaus may know this information. What does affect your credit score is your credit utilization ratio. This is how much money you're spending on your credit cards compared to your spending limit each month. To lower your credit utilization, and positively impact your credit score you want to be sure to use only 30% or less of your total credit limits.