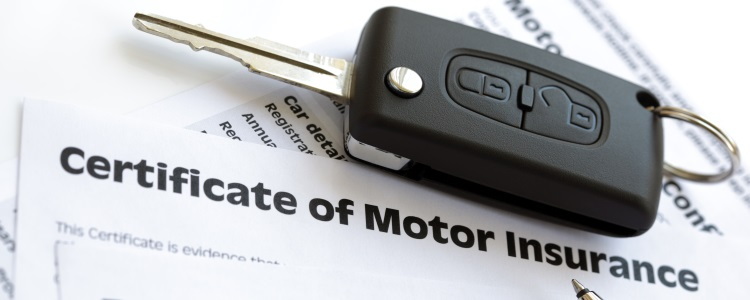

When you have bad credit and have struggled in purchasing a vehicle, it is important to protect yourself and your new car with the best coverage possible. Car buyers sometimes assume that a full coverage insurance policy does this, but for those with an auto loan without GAP insurance, this may not be the case. It is, therefore, important to understand your insurance policy and exactly what it covers.

If you have an auto loan, especially one with a higher interest rate due to bad credit, you run the risk of being "upside down" in the loan for a longer period of time. This is called negative equity, and it means you owe more on the loan than the car is worth.

If you have an auto loan, especially one with a higher interest rate due to bad credit, you run the risk of being "upside down" in the loan for a longer period of time. This is called negative equity, and it means you owe more on the loan than the car is worth.

This can be truly devastating, financially speaking, if your vehicle is totaled or stolen. This is also where guaranteed asset protection (GAP) insurance shines. It can prevent you from being stuck paying on a vehicle that you no longer have or cannot drive.

Mind the Gap

Just as its name implies, GAP insurance covers the gap between what is owed on the loan and the market value of the vehicle at the time of the accident. It is usually available for newer vehicles and can be purchased through insurance providers, dealerships, and other third-party companies.

Think you can handle the blow to your pocketbook if your vehicle is stolen or damaged beyond repair? Here are some factors that may leave you falling into the gap.

- You were underwater in your last trade-in—You can trade in a vehicle with negative equity, but it may not be the right option for you. It is quite common to be upside down these days. In fact, according to Edmunds.com, more than six million consumers were upside down in their trade-ins in 2016. Just know that if you don't pay off the difference upfront, the amount you still owe will be rolled into your new loan. This means you'll be even further underwater from the start, which could be an even bigger problem if you suffer a total loss.

- You leapt at the option of a small down payment—Without a substantial down payment, your equity situation can flip as soon as you drive off the lot. A good tip is to try and squirrel away enough to cover at least a 20 percent down payment to help build equity in your vehicle. It is also a good idea to have the cash to cover any tax, title, and license fees, because financing less than the vehicle’s value will help reduce the amount of negative equity you'll be facing.

- You’ve hopped on the long-term train—An auto loan can be an excellent way to build credit, but only if it is used correctly. While longer term auto loans are on the rise, this is not a good idea if you have credit challenges. A longer loan term means higher interest charges. By shortening the length of your loan, you'll lower the time you are upside down and reduce the interest charges you'll pay.

- You’ve accelerated your depreciation—Cars lose value with every mile, so racking up miles quickly can result in a big difference in your car's value compared to what you owe. The ideal goal would be to pay your loan off while maintaining a balance that matches or beats your vehicle's depreciation. However, if you plan to do a lot of driving, this may not be possible.

Minimize the Difference

It is always a good idea to try and maintain equity in your vehicle so that you are not facing an insurmountable payment if you are looking at a total loss. Things like a down payment and purchasing a car with good resale value can help. Another helpful tip is to purchase a one- or two-year-old certified pre-owned vehicle. These vehicles have already seen their sharpest drop in value, and if you sell or trade one in after only three years, you may be able to stay ahead of the depreciation curve.

But above all, you have to know the details of you car insurance coverage. Even if you did not get GAP insurance at the time you bought your car, it can typically be purchased later on.

The Bottom Line

Being well insured is always your best bet when it comes to protecting your belongings. As for protecting your vehicle, make sure you know all of your options—including bridging the gap between what you owe and what it's worth. Instead of being stuck paying on a vehicle that was a total loss, consider covering your next car loan with GAP insurance.

If you are currently in need of a vehicle, let Auto Credit Express help you get started. Our network of dealers can provide options for consumers who have less than perfect credit. Take the first step toward your next vehicle by filling out our auto loan request form now.